Are Solar Thermal Power Plants Doomed?

by Michael Kanellos, Brett Prior

Concentrating Solar Power [CSP] is one of our favorite renewable energy technologies, but it might be in serious trouble. And this time the culprit is not cheap natural gas, the Koch Brothers, nor the desert tortoise advocates.

This time, the adversary is the other half of the solar family.

Just to clarify, CSP includes all concentrating solar thermal (CST) technologies, such as trough, tower, and dish-engine - as well as concentrating PV (CPV) technologies including companies such as Amonix, SolFocus, and Concentrix.

The CSP industry began to flourish in the late 1980s and early 90s in California, with the construction of 354 megawatts of parabolic trough plants in the Mojave Desert.

Then, the state allowed a real estate tax exemption lapse, a change in the law that companies like Solel and Luz warned would kill them. Right after Luz ran out of money, then Governor Pete Wilson signed an extension.

A second wave began around 2004 with the revival of green technology in the state. Luz founder Arnold Goldman rounded up the old team, recruited some new execs and founded BrightSource Energy. Peter Le Lievre and a group of Australians came up with Ausra and built a plant in Las Vegas.

Advocates said that solar thermal plants, if 500 megawatts or larger, could rival natural gas in cost per kilowatt hour. Another lapse in the property tax exemption loomed, but was avoided.

But then the 2008 financial crisis hit. The sudden decline of funding hit the industry particularly hard, considering that a demo plant costs around $25mm and a commercial plant requires somewhere north of $250mm. Ausra and eSolar had to retool their strategies, while BrightSource had to sell part of its first project at Ivanpah to Bechtel.

If that weren’t enough, environmentalists and U.S. Senator Dianne Feinstein pushed to declare a million acres of the Mojave a protected zone. Concerns about desert tortoises forced BrightSource to scale Ivanpah down to 370 megawatts. It was as if 19th Century coal miners blamed their lot on the gruel purity standards being imposed on mining camp cafeterias.

But the projects have, in recent weeks, begun to get the necessary approvals from the California Energy Commission and the Bureau of Land Management, just in time to qualify for the Treasury Grant program.

So the near term outlook for CSP looks pretty bright, as BrightSource's Ivanpah, Abengoa's (ABGOY.PK) Solana, and Tessera's (TSRA) Imperial all look likely to break ground this year.

So, what could derail CSP's longer term prospects?

PV, that’s what.

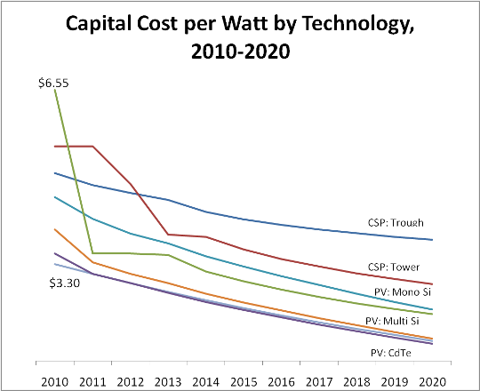

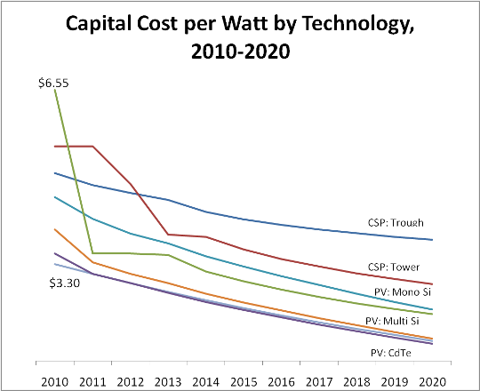

The relentless price declines of PV panels allows developers to build PV plants at a lower cost than their CST cousins. This issue is illustrated in the following Capital Cost per watt chart (an excerpt from the upcoming GTM Research "CSP Report"). In 2010, the price to build a CSP park run by Troughs, Power Towers or Dish-Engines will cost between $5.00 and $6.55 per watt (AC). On the other hand, utility-scale PV projects can limbo below $3.50 a watt (DC).

By 2020, the CSP solutions are expected to be in the $2.40-$3.80 per watt (AC) range, but by that time PV plants could be below $2 a watt (DC). Trough & Tower plants are behind PV, and not likely to catch up.

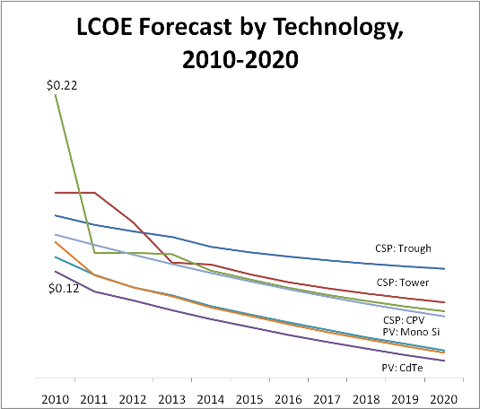

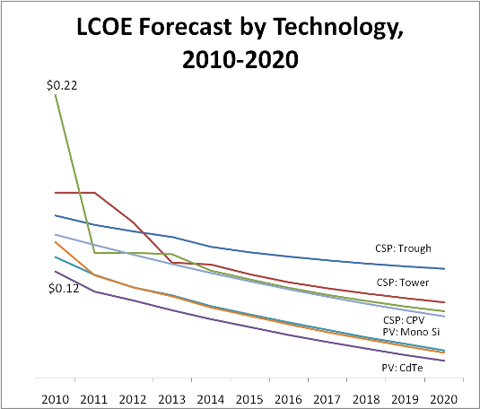

The better comparison is levelized cost of energy (LCOE) - as this corrects for the DC-to-AC conversion that PV needs to deal with, the differences in O&M, and the differing amounts of kWh generated per watt of equipment installed (as yields vary by technology).

This second chart depicts the LCOE on an apples-to-apples basis (same location, same plant size, same financing terms). Again, PV is cheaper today, and expected to widen its edge over the next decade. By 2020, the CSP technologies are expected to be in the $0.10-$0.12/kWh range, whereas PV is forecast between $0.07-$0.08/kWh.

A bleak outlook?

As a sign of the times, NRG Energy (NRG) decided that instead of building CSP plants using eSolar Towers, it would use the sites for PV plants. The company did this both in California (Alpine SunTower), and in New Mexico.

This sort of reversal wasn’t expected in 2006 or 2007, but since then the Chinese have ramped up their solar PV manufacturing, the cost of polysilicon has slid dramatically, and the overall cost of PV modules has declined significantly. Both Solon (SGFRF.PK) and SunPower (SPWRA) now make solar power plants “in a box” that can generate 1 megawatt. They come straight from the factory on big rigs.

If you accept the following 2 premises, the future for CSP looks pretty bleak.

1) PV is now cheaper than CSP on a levelized cost basis, and will reduce its costs faster than CSP going forward

2) When awarding solar power purchase agreements ((PPAs)), utilities will choose the lowest price option

What could prevent this scenario from coming to pass?

One possibilty is that utilities are willing to pay a premium for CSP plants for one of two reasons:

i) CST plants produce more consistent power output (less spikiness). These plants can produce power fairly consistently throughout the day because of the inertia of the turbine and the ability to burn natural gas when clouds roll in. When clouds blanket a PV plant - the output can drop off a cliff. The last time the solar thermal plants in the Mojave experienced an eyebrow-raising drop in power it was because Mt. Pinatubo blew.

ii) CST power plants fit naturally with storage systems and can even continue to produce power at night. For now, if utilities want solar with storage, the only economic option is CST (trough or tower). Perhaps at some point in the future new technologies like sodium batteries and dry cell batteries from Xtreme Power may help PV developers even the storage gap.

Are utilities willing to take quality or storage into account? Apparently not at the moment.

“Utilities aren’t willing to pay for consistency and storage,” said Brad Friesen, Vice President of the Renewables business line at Fluor, one of the largest EPC (engineering, procurement, & construction) firms in the world. Most of the utilities are concerned about meeting their renewable portfolio requirements, he said. Five years from now utilities might question their thinking, he added, but right now, these considerations are not given much weight.

And price is not the only area where CST plants are disadvantaged.

Lack of Modularity

Trough and tower plants require large turbines to operate - and the economics for steam turbines only work with 50 MW+ plants. So modularity is not an option for CST plants.

Developers have figured out that it is much easier (and faster) to site, permit and get transmission arranged for a sub-20 MW plant than it is for a larger project. That effectively rules out trough and tower - but allows for traditional flat-plate PV, CPV, and potentially Dish-Engine options.

Restricted geography

The economics of CST require that they be located in a more constrained geographic band.

Conclusion?

Solar thermal still has a lot of appeal. Some of the newer technologies (towers & dish-engines) are just coming out and may surprise us in their ability to lower costs. Other technologies like SolarReserve’s cycling salt could further wring out inefficiencies. (Friesen is a fan of SolarReserve). When quality and storage are required, solar thermal comes out cheaper than nuclear. The capital for nuclear plants cost $6,000 a kilowatt, or $6 a watt, or more, not including waste storage, and often rise higher than expected. Thermal plants may not run all night, but they provide consistent power in the day when needed. The question is whether the CST industry can survive until its competitive advantages are truly valued by the utilities.

"There is a role for solar thermal. If it is North Africa, that is fantastic," said Travis Bradford, founder of the Prometheus Institute and a professor at the University of Chicago. "But the difference (in the amount of total energy that will be produced by utility solar parks) between solar thermal and PV will be at least an order of magnitude. Maybe two." That is to say that if PV will see annual installations of 20,000 MW per year in the middle of this decade, perhaps CST will be more in the realm of 200-2,000 MW per year. Not a particularly rosy outlook.

It's like that old, painful axiom in semiconductors.

Don’t bet against silicon.

Disclosure: No positions

Concentrating Solar Power [CSP] is one of our favorite renewable energy technologies, but it might be in serious trouble. And this time the culprit is not cheap natural gas, the Koch Brothers, nor the desert tortoise advocates.

This time, the adversary is the other half of the solar family.

Just to clarify, CSP includes all concentrating solar thermal (CST) technologies, such as trough, tower, and dish-engine - as well as concentrating PV (CPV) technologies including companies such as Amonix, SolFocus, and Concentrix.

The CSP industry began to flourish in the late 1980s and early 90s in California, with the construction of 354 megawatts of parabolic trough plants in the Mojave Desert.

Then, the state allowed a real estate tax exemption lapse, a change in the law that companies like Solel and Luz warned would kill them. Right after Luz ran out of money, then Governor Pete Wilson signed an extension.

A second wave began around 2004 with the revival of green technology in the state. Luz founder Arnold Goldman rounded up the old team, recruited some new execs and founded BrightSource Energy. Peter Le Lievre and a group of Australians came up with Ausra and built a plant in Las Vegas.

Advocates said that solar thermal plants, if 500 megawatts or larger, could rival natural gas in cost per kilowatt hour. Another lapse in the property tax exemption loomed, but was avoided.

But then the 2008 financial crisis hit. The sudden decline of funding hit the industry particularly hard, considering that a demo plant costs around $25mm and a commercial plant requires somewhere north of $250mm. Ausra and eSolar had to retool their strategies, while BrightSource had to sell part of its first project at Ivanpah to Bechtel.

If that weren’t enough, environmentalists and U.S. Senator Dianne Feinstein pushed to declare a million acres of the Mojave a protected zone. Concerns about desert tortoises forced BrightSource to scale Ivanpah down to 370 megawatts. It was as if 19th Century coal miners blamed their lot on the gruel purity standards being imposed on mining camp cafeterias.

But the projects have, in recent weeks, begun to get the necessary approvals from the California Energy Commission and the Bureau of Land Management, just in time to qualify for the Treasury Grant program.

So the near term outlook for CSP looks pretty bright, as BrightSource's Ivanpah, Abengoa's (ABGOY.PK) Solana, and Tessera's (TSRA) Imperial all look likely to break ground this year.

So, what could derail CSP's longer term prospects?

PV, that’s what.

The relentless price declines of PV panels allows developers to build PV plants at a lower cost than their CST cousins. This issue is illustrated in the following Capital Cost per watt chart (an excerpt from the upcoming GTM Research "CSP Report"). In 2010, the price to build a CSP park run by Troughs, Power Towers or Dish-Engines will cost between $5.00 and $6.55 per watt (AC). On the other hand, utility-scale PV projects can limbo below $3.50 a watt (DC).

By 2020, the CSP solutions are expected to be in the $2.40-$3.80 per watt (AC) range, but by that time PV plants could be below $2 a watt (DC). Trough & Tower plants are behind PV, and not likely to catch up.

The better comparison is levelized cost of energy (LCOE) - as this corrects for the DC-to-AC conversion that PV needs to deal with, the differences in O&M, and the differing amounts of kWh generated per watt of equipment installed (as yields vary by technology).

This second chart depicts the LCOE on an apples-to-apples basis (same location, same plant size, same financing terms). Again, PV is cheaper today, and expected to widen its edge over the next decade. By 2020, the CSP technologies are expected to be in the $0.10-$0.12/kWh range, whereas PV is forecast between $0.07-$0.08/kWh.

A bleak outlook?

As a sign of the times, NRG Energy (NRG) decided that instead of building CSP plants using eSolar Towers, it would use the sites for PV plants. The company did this both in California (Alpine SunTower), and in New Mexico.

This sort of reversal wasn’t expected in 2006 or 2007, but since then the Chinese have ramped up their solar PV manufacturing, the cost of polysilicon has slid dramatically, and the overall cost of PV modules has declined significantly. Both Solon (SGFRF.PK) and SunPower (SPWRA) now make solar power plants “in a box” that can generate 1 megawatt. They come straight from the factory on big rigs.

If you accept the following 2 premises, the future for CSP looks pretty bleak.

1) PV is now cheaper than CSP on a levelized cost basis, and will reduce its costs faster than CSP going forward

2) When awarding solar power purchase agreements ((PPAs)), utilities will choose the lowest price option

What could prevent this scenario from coming to pass?

One possibilty is that utilities are willing to pay a premium for CSP plants for one of two reasons:

i) CST plants produce more consistent power output (less spikiness). These plants can produce power fairly consistently throughout the day because of the inertia of the turbine and the ability to burn natural gas when clouds roll in. When clouds blanket a PV plant - the output can drop off a cliff. The last time the solar thermal plants in the Mojave experienced an eyebrow-raising drop in power it was because Mt. Pinatubo blew.

ii) CST power plants fit naturally with storage systems and can even continue to produce power at night. For now, if utilities want solar with storage, the only economic option is CST (trough or tower). Perhaps at some point in the future new technologies like sodium batteries and dry cell batteries from Xtreme Power may help PV developers even the storage gap.

Are utilities willing to take quality or storage into account? Apparently not at the moment.

“Utilities aren’t willing to pay for consistency and storage,” said Brad Friesen, Vice President of the Renewables business line at Fluor, one of the largest EPC (engineering, procurement, & construction) firms in the world. Most of the utilities are concerned about meeting their renewable portfolio requirements, he said. Five years from now utilities might question their thinking, he added, but right now, these considerations are not given much weight.

And price is not the only area where CST plants are disadvantaged.

Lack of Modularity

Trough and tower plants require large turbines to operate - and the economics for steam turbines only work with 50 MW+ plants. So modularity is not an option for CST plants.

Developers have figured out that it is much easier (and faster) to site, permit and get transmission arranged for a sub-20 MW plant than it is for a larger project. That effectively rules out trough and tower - but allows for traditional flat-plate PV, CPV, and potentially Dish-Engine options.

Restricted geography

The economics of CST require that they be located in a more constrained geographic band.

Conclusion?

Solar thermal still has a lot of appeal. Some of the newer technologies (towers & dish-engines) are just coming out and may surprise us in their ability to lower costs. Other technologies like SolarReserve’s cycling salt could further wring out inefficiencies. (Friesen is a fan of SolarReserve). When quality and storage are required, solar thermal comes out cheaper than nuclear. The capital for nuclear plants cost $6,000 a kilowatt, or $6 a watt, or more, not including waste storage, and often rise higher than expected. Thermal plants may not run all night, but they provide consistent power in the day when needed. The question is whether the CST industry can survive until its competitive advantages are truly valued by the utilities.

"There is a role for solar thermal. If it is North Africa, that is fantastic," said Travis Bradford, founder of the Prometheus Institute and a professor at the University of Chicago. "But the difference (in the amount of total energy that will be produced by utility solar parks) between solar thermal and PV will be at least an order of magnitude. Maybe two." That is to say that if PV will see annual installations of 20,000 MW per year in the middle of this decade, perhaps CST will be more in the realm of 200-2,000 MW per year. Not a particularly rosy outlook.

It's like that old, painful axiom in semiconductors.

Don’t bet against silicon.

Disclosure: No positions

Business

Business