What Happens When the Incentives Expire?

By Bruce Hamilton, Director of Energy, Navigant Consulting, Inc.,

Reproduced from RenewableEnergyWorld.com

May 17, 2011

Sacramento, CA, USA -- Wind projects, along with other renewable energy technologies, have benefitted in a variety of ways from federal incentive programs. The Section 1603 cash grant program, the Department of Energy Section 1705 Loan Guarantee program and the Bonus Depreciation schedule are among the federal programs that are scheduled to expire by the end of 2012. The Production Tax Credit (PTC) and Investment Tax Credit (ITC) are also scheduled to expire for wind projects at the end of 2012. In today's budget-cutting environment, it's possible that none of these incentives will be renewed.

The Section 1603 cash grant has been a popular and successful program and is generally credited for keeping the U.S. wind industry healthy during the 2009-2010 recession1. Since the program was initiated in 2009 through the first quarter of 2011, $5.6 billion in cash grants has been awarded for wind projects, representing more than 80 percent of all Section 1603 funding to date.

The DOE Section 1705 loan guarantee program has a current allocation of $2.5 billion that can support up to $30 billion of loan guarantees. As of April 2011, three wind plants have received commitments for loan guarantees totaling $1.5 billion, including $1.3 billion for Caithness's 845 MW Shepherd's Flat project.

Under the federal Modified Accelerated Cost-Recovery System (MACRS), wind and other renewable energy properties are classified as five-year property for depreciation purposes. Eligible property placed in service after Sept. 8, 2010 and before Jan. 1, 2012 qualifies for 100 percent first-year bonus depreciation, meaning that 100 percent of the project cost can be expensed in the first year. For 2012, a 50 percent bonus depreciation is still available. After Dec. 31, 2012, the allowable deduction reverts to the original five-year MACRS recovery. The value of the 100 percent bonus is estimated to be 40 percent of the value of the Section 1603 cash grant.

To determine the impact of the pending expiration of these programs, Navigant calculated the Levelized Cost of Energy (LCOE) for a 100 MW wind plant in various time frames with the following project finance structures:

•Case 1. Circa 2008, using the PTC, equity from the project sponsor (20 percent), and a tax equity partnership flip (80 percent).2

•Case 2. Circa 2011, using the cash grant (30 percent), equity from the project sponsor (20 percent), a DOE loan guarantee (40 percent) and a private loan (10 percent). 3

•Case 3. Circa 2013, using the PTC, equity from the project sponsor (20 percent) and a tax equity partnership flip (80 percent), assuming that the PTC will be renewed.4

•Case 4. Circa 2013, using the project sponsor's equity (70 percent) and a private loan (30 percent), assuming that the PTC is not renewed.5

Navigant also calculated the range of LCOE prices from natural gas fired power plants during these same time periods.6 The results of the four cases are shown in the graph.

The case studies show that wind plants are competitive with gas plants in Cases 1 and 2, which is consistent with the fact that many utilities have installed wind plants well in excess of their Renewable Portfolio Standard (RPS) requirements. In comparing Cases 1 and 2, the combined effect of the cash grant and the DOE loan guarantee cuts the cost of a wind farm nearly in half. In comparing Cases 1 and 3, increased return requirements from tax equity investors are a significant factor in driving wind LCOEs higher. In comparing the wind plant LCOEs of Cases 3 and 4 with their corresponding gas plant LCOEs, wind will not be competitive with gas in 2013, either with or without the PTC. Plenty of wind plants will still be built, but with the current cost structures in place and unless federal incentives are renewed or replaced, post-2012 U.S. wind markets will be driven primarily by RPS requirements rather than competing head-to-head with gas projects.

Bruce Hamilton (left) is Director of Energy at Navigant Consulting, Inc.

--------------------------------------------------------------------------------

Footnotes

1. According to the DOE's Preliminary Evaluation of the Impact of the Section 1603 Treasury Grant Program on Renewable Energy Deployment in 2009 (Bolinger, Wiser, and Darghouth, April 2010), the grant program may have helped directly motivate as much as 2,400 MW of wind capacity to be built that would not otherwise have come online in 2009.

2. Case 1 assumes a 6% annual return for tax equity investors, which was typical in 2008 when there were plenty of investors compared to the number of quality projects. The wind plant capital cost is assumed to be $2,000/kW for all cases.

3. Case 2 assumes a 2011 cost of debt of 4%/year plus a 2.5% up-front fee. The cost of tax equity is currently 9%/year, plus a 3% premium for projects with debt. Only Case 2 assumes bonus depreciation.

4. Case 3 assumes a 9% annual return for tax equity investors in 2013. If the number of tax equity investors does not significantly increase and new structures do not appear, the cost of tax equity will remain at the elevated 2011 levels.

5. Case 4 assumes that the cost of project debt in 2013 will follow inflation and return to 2008 levels of 6%/year plus a 2.5% up-front fee.

6. Natural gas prices are assumed to be $3.48 to $4.91/MMBtu in 2011 and $4.14 to $5.75/MMBtu in 2013.

Showing posts with label government grant. Show all posts

Showing posts with label government grant. Show all posts

Tuesday, May 17, 2011

Monday, April 25, 2011

Update on California's Upcoming Utility-Scale Solar Projects from The Desert Sun

Solar: California's new gold rush

Green energy offers the prospect of an economic boon, but some worry the environmental, cultural cost is too high

The Desert Sun - Keith Matheny

It's been called California's second gold rush: the clamor by large solar companies to stake a claim in southern California's open deserts and capture one of its most abundant resources — sunlight.

While many cheer the cleaner energy and economic possibilities utility-scale solar development may bring to a job-starved region, some environmentalists, Native Americans and others are critical of the process, saying it's running roughshod over threatened plant and animal species and culturally sensitive areas.

The California Energy Commission and federal Department of the Interior have approved eight major solar projects in Southern California since last year, including seven projects in the deserts north and east of the Coachella Valley. All but two of the approved plans utilize largely undeveloped public land managed by the federal Bureau of Land Management. The projects are expected to generate:

• Nearly 3,600 megawatts of non-carbon-emitting electricity, enough to power almost 1.8 million homes.

• Some 5,500 jobs during construction of the projects, and nearly 1,000 long-term operational jobs.

• More than $15.2 million in annual property taxes, and hundreds of millions more in sales taxes as the projects are built.

Another eight utility-scale solar projects are also in the permitting pipeline for Riverside and Imperial counties, promising an additional 2,173 megawatts of renewable energy generation. And long-range plans are in the works that could open up millions more public acres to solar development in six western states, with the largest proposed solar energy zone in Riverside County.

“California is the national leader in clean energy, and our great state is poised to become the world leader in renewable energy generation,” Gov.Jerry Brown said Monday.

Brown earlier this month signed a bipartisan bill to further increase California's renewable energy portfolio standard, now requiring that utilities get one-third of their electricity from renewable sources by 2020, up from 20percent.

Critics contend the politically driven fast track to approving projects on tens of thousands of acres of public lands will cause irreparable damage to threatened plant and animal species, as well as to historic, prehistoric and culturally important sites.

“The irony is, in the name of saving the planet, we're casting aside 30 or 40 years of environmental law. It's really a type of frenzy,” said Christine Hersey, a solar analyst at Wedbush Securities who closely follows environmental concerns associated with solar projects.

It's an issue that pits green against green, environmentalists prioritizing the reduction of atmospheric emissions that contribute to climate change versus those most interested in threatened species and the near-pristine desert ecosystem.

“When you take a look at the political climate, the economy, and you add that to the recent media notoriety of the climate crisis — which I'm not a skeptic of at all — you've got a rather vicious cocktail where environmental groups don't really know how to handle this,” said Kevin Emmerich, a former park ranger turned biological consultant who lives in the Mojave Desert in Beatty, Nev., just across the border from California.

“A lot of them are thinking, ‘The climate's changing; the desert is disappearing anyway; we may have to sacrifice some in order to save the rest.' That support has helped expedite this process.”

The state of California and federal government are spurring the desert solar development, offering billions of dollars in federal loan guarantees, cash grants and tax breaks. On Monday, U.S. Energy Secretary Steven Chu announced $2.1 billion in federal loan guarantees for one project, a 1000-megawatt proposal near Blythe.

Another solar plant in development, Ivanpah in eastern San Bernardino County, received $1.37 billion in federal loan guarantees in February.

Janine Blaeloch, executive director of the nonprofit Western Lands Project, questioned the huge taxpayer commitment to the solar projects.

Blaeloch is a member of Solar Done Right, a coalition of public land activists, solar power and electrical engineering experts, biologists and renewable energy advocates critical of placing large solar projects on relatively unspoiled public land. She co-authored a report released earlier this month on governmental push for solar in the open desert, entitled “Wrong from the Start.”

She noted that corporate investors in companies developing solar projects in the California desert include Chevron, BP, Morgan Stanley and Goldman Sachs.

“It's big money and big oil,” she said. “It's the same people who have driven us into the hole we're in now trying to get us into another one.”

Perhaps ironically to some, the modern push for large-scale desert solar, it can be argued, started under former President George W. Bush and California Republican Gov. Arnold Schwarzenegger.

“The gold rush really started after George W. Bush signed the Energy Policy Act of 2005,” which provided tax incentives and loan guarantees for California desert solar development, Hersey said. “That's what really started the speculators.”

Under Democratic Gov. Gray Davis, California in 2002 passed a renewable energy portfolio standard calling for 20 percent of California's electricity to come from renewable sources by 2017. Schwarzenegger in 2006 moved the 20 percent target up to 2010.

Interest in solar development on federal land in the Southern California desert jumped from 20 applications in 2006 to about 150 the following year, said Greg Miller, BLM renewable energy program manager for the California Desert District.

“We had what we called a land rush,” he said.

BLM had previously approved use of federal desert lands for things such as power line corridors — never anything of the size of solar energy projects, Miller said.

“We were kind of learning as we were going,” he said.

In 2008, Schwarzenegger signed Executive Order S-14-08, streamlining renewable energy permitting and collaborating with federal agencies to develop the Desert Renewable Energy Conservation Plan, to facilitate desert energy development while maintaining natural resources conservation.

The push for solar has continued and expanded under Democratic President Barack Obama, whose administration has made green energy a priority, Hersey said.

“They can't do it fast enough,” she said.

Schwarzenegger and U.S. Interior Secretary Ken Salazar in October 2009 signed a memorandum of understanding between the state and Department of Interior that, among other things, developed a fast-track permit approval process allowing as many large-scale solar projects that could to begin construction by Dec. 1, 2010, making them eligible for American Recovery and Reinvestment Act, or federal stimulus, funding.

The fast-tracking “demonstrates how separate government processes can be coordinated without cutting corners or skipping any environmental checks and balances in the projects,” Salazar said Oct. 25 as he announced approval of the Blythe solar project.

BLM Director Bob Abbey in October acknowledged what was at stake.

“With something as momentous as the introduction of large-scale solar development on the public lands, we have one chance to do things right,” he said. “That's why we did complete environmental analyses on these projects with expanded opportunities for public participation.”

But Blaeloch questions that assertion.

“They are not saying to the public, ‘We want to know how you feel about this;' They're saying, ‘We're going to do this and you can comment on it if you want,'” she said.

“These solar plants will introduce a huge amount of damage to our public land and habitat. The sites will be turned into permanent industrial zones. Even if the plants are dismantled after their life is expired, you cannot restore the desert to what it was.”

Solar Done Right's report contends government officials could take advantage of already disturbed lands such as brownfield sites and former agricultural fields. The U.S. Environmental Protection Agency identified hundreds of thousands of acres of such sites, with the potential to generate 920,000 megawatts of solar electricity, the report notes. Distributed generation on rooftops is another option, Blaeloch said.

“I think those are really good questions to ask,” said Amy Fesnock, BLM's chief wildlife biologist in California.

“BLM doesn't have the ability to say, ‘Go build this on private land.' We don't have authority on private land. We can only assess the projects that are presented to us, on lands over which we have authority.”

BLM stands to bring in more than $10.2 million a year in rental fees from the solar companies permitted or nearing approval to locate in the desert, along with more than $25 million in additional megawatt capacity fees.

Hashing out the details

Though projects are approved with thick, multi-volume environmental impact statements, many details aren't yet resolved and are being worked out on the fly as work commences, including final plans on what will ultimately happen with endangered desert tortoise found on solar project sites.

Preliminary plans include moving the tortoise to other habitats, known as translocation — a controversial practice that top tortoise biologists say leads to high mortality rates.

A panel of independent scientists in October prepared a report for officials working on the Desert Renewable Energy Conservation Plan, that concluded: “In general, moving organisms from one area to another ... is not a successful conservation action and may do more harm than good to conserved populations by spreading diseases, stressing resident animals, increasing mortality, and decreasing reproduction and genetic diversity.

“Transplantation or translocations should be considered a last recourse for unavoidable impacts, (and) should never be considered full mitigation for the impact.”

In approving Ivanpah, California Energy Commissioners stated, “We assume that a substantial number of translocated tortoise may perish.”

But commissioners concluded the proposed mitigation efforts will make the impacts acceptable.

“Whether to approve this project or not is a policy decision to be made by the Energy Commission, after considering all the relevant factors, including scientific opinion,” they stated. “Input from the Advisory Panel is informative but we are not bound by any policy recommendations it makes.”

In addition to tortoise, the commission listed numerous other impacts from Ivanpah: loss of multiple-use lands, loss of habitat for the threatened Mojave milkweed and desert pincushion, increased traffic on Interstate 15 and degradation of scenic vistas. However, the commission found, the “project benefits outweigh the significant impacts identified.”

“The project helps address a global climate change problem of paramount importance and responds to state laws requiring a shift to renewable electricity sources,” the energy commission's Ivanpah decision states.

“Overriding concern” citations were used by the energy commission in the approval of other desert solar projects as well, said Jim Andre, a desert botanist with UC-Riverside's Granite Mountains Desert Research Center in eastern San Bernardino County.

“A decision is being made to waive significant impacts and to go forward with these projects as quickly as possible, without even acknowledging the science,” he said.

It's a similar story with cultural resources.

A June Energy Commission staff report on the Genesis solar project looked at cumulative impacts on cultural sites from past, present and likely future solar development.

“This analysis estimates that more than 800 sites within the I-10 corridor, and 17,000 sites within the Southern California Desert Region, will potentially be destroyed,” the report stated. “Mitigation can reduce the impact of this destruction, but not to a less-than-significant level.”

An economic boon

But large-scale desert solar development proponents say use of the BLM-managed lands provides an opportunity to shape projects in ways that minimize negative impacts that other tracts of land might not.

First Solar, a company based in Tempe, Ariz., is nearing final approval of its Desert Sunlight project, a photo-voltaic solar plant planned north of Desert Center, a tiny community about 50 miles east of Indio off Interstate 10.

The project at its inception secured 19,000 acres of BLM land, studied it with biologists and archaeologists, then scaled and modified the project footprint to minimize impacts to biological and cultural resources, First Solar project director Kim Oster said.

Removed were a bighorn sheep movement corridor, a potential desert tortoise corridor, an area of threatened foxtail cactus and “significant prehistoric resources,” she said.

“To combat climate change, changing our energy use has to be part of the solution. It will provide a significant solution to global warming for the future, while providing green jobs now.”

First Solar on Monday informed Desert Center community leaders of plans to provide a $350,000 community development fund for locally identified priorities such as local school and library improvements.

“Everybody around here thinks it's a great project,” said Ken Statler, owner of McGoo's Country Store in Desert Center.

“They're willing to help out the county and the area. There are no jobs available out here.”

The solar construction and ongoing operational jobs will “undoubtedly” help his store, Statler said.

“Where else are they going to get anything?” he said. “We had two other mini-marts out here and they closed down. You can't get gasoline; it's closed down.

“We need some life out here in the desert. That will definitely help us.”

Desert Center resident John Beach earlier this month landed a job in procurement with NextEra's Genesis project.

The currently proposed projects “bring an economic boost to an area that has very high unemployment and not very much in the way of business,” he said.

But community members generally are more apprehensive about what may be coming later, Beach said.

Federal agencies are currently working on an overarching framework for solar development on public lands in six western states, including California, called a solar programmatic environmental impact statement.

The plan calls for creation of 24 federally designated solar energy zones, areas deemed most likely to work for large-scale solar development while minimizing environmental and cultural impacts. The largest of the zones, at 202,000 acres, is in eastern Riverside County's open deserts.

“That's not reasonable,” Beach said.

“We're going to end up having a disproportionate share of all of the projects and having no more open desert. People are saying that doesn't sound right.”

But the federal report recommends opening up even more land to solar development than the 667,384 acres currently under consideration across western states. Another 21.5 million acres of federal land could be considered for renewable energy development, including 1.7 million more acres in California, with 205,000 acres of the total in the deserts surrounding the Coachella Valley.

Though more than a dozen major solar projects have been approved or are nearing approval, the work on considering the cumulative impacts of them all is in many ways only beginning.

The Desert Renewable Energy Conservation Plan is not scheduled for completion until next year.

“The goal of the DRECP is to approach renewable energy in a more organized fashion. The question really is, will that be in place in time to be of benefit to the planning?” said Gail Barton, principle planner for Riverside County and the county's representative on the committee developing the plan.

Solar projects are currently being considered “consistently with the law,” Barton said.

“Is that the best kind of planning? Probably not. With more comprehensive planning, you tend to look more thoughtfully at things.”

In December, after approving seven large desert solar projects, the California Energy Commission solicited applicants to conduct a study examining the “cumulative biological impacts framework for solar energy projects in the California desert.”

A Sierra Club lawsuit against the Calico solar project in San Bernardino county was dismissed by the California Supreme Court April 13. Legal challenges remain on other solar projects, filed by both environmentalists and tribal members who claim they were not properly consulted, and that the projects fail to protect species and cultural sites as required under federal law.

To many in the rest of the country, local concerns about the desert solar projects' impacts aren't the priority.

“Societally, this is the kind of change that helps the whole country, the whole world,” said Kenneth Zweibel, director of the George Washington University Solar Institute in Washington, D.C.

“There's much bigger value in helping the whole society, the whole world, than in the local issues. Something you are trying to protect is being changed, but it's helping so much in terms of climate change, energy self sufficiency and clean energy, it's a sacrifice that's appropriate to take.”

|

Laura Abram of First Solar holds a photograph with a simulated image |

Green energy offers the prospect of an economic boon, but some worry the environmental, cultural cost is too high

The Desert Sun - Keith Matheny

It's been called California's second gold rush: the clamor by large solar companies to stake a claim in southern California's open deserts and capture one of its most abundant resources — sunlight.

While many cheer the cleaner energy and economic possibilities utility-scale solar development may bring to a job-starved region, some environmentalists, Native Americans and others are critical of the process, saying it's running roughshod over threatened plant and animal species and culturally sensitive areas.

The California Energy Commission and federal Department of the Interior have approved eight major solar projects in Southern California since last year, including seven projects in the deserts north and east of the Coachella Valley. All but two of the approved plans utilize largely undeveloped public land managed by the federal Bureau of Land Management. The projects are expected to generate:

• Nearly 3,600 megawatts of non-carbon-emitting electricity, enough to power almost 1.8 million homes.

• Some 5,500 jobs during construction of the projects, and nearly 1,000 long-term operational jobs.

• More than $15.2 million in annual property taxes, and hundreds of millions more in sales taxes as the projects are built.

Another eight utility-scale solar projects are also in the permitting pipeline for Riverside and Imperial counties, promising an additional 2,173 megawatts of renewable energy generation. And long-range plans are in the works that could open up millions more public acres to solar development in six western states, with the largest proposed solar energy zone in Riverside County.

“California is the national leader in clean energy, and our great state is poised to become the world leader in renewable energy generation,” Gov.Jerry Brown said Monday.

Brown earlier this month signed a bipartisan bill to further increase California's renewable energy portfolio standard, now requiring that utilities get one-third of their electricity from renewable sources by 2020, up from 20percent.

Critics contend the politically driven fast track to approving projects on tens of thousands of acres of public lands will cause irreparable damage to threatened plant and animal species, as well as to historic, prehistoric and culturally important sites.

“The irony is, in the name of saving the planet, we're casting aside 30 or 40 years of environmental law. It's really a type of frenzy,” said Christine Hersey, a solar analyst at Wedbush Securities who closely follows environmental concerns associated with solar projects.

It's an issue that pits green against green, environmentalists prioritizing the reduction of atmospheric emissions that contribute to climate change versus those most interested in threatened species and the near-pristine desert ecosystem.

“When you take a look at the political climate, the economy, and you add that to the recent media notoriety of the climate crisis — which I'm not a skeptic of at all — you've got a rather vicious cocktail where environmental groups don't really know how to handle this,” said Kevin Emmerich, a former park ranger turned biological consultant who lives in the Mojave Desert in Beatty, Nev., just across the border from California.

“A lot of them are thinking, ‘The climate's changing; the desert is disappearing anyway; we may have to sacrifice some in order to save the rest.' That support has helped expedite this process.”

The state of California and federal government are spurring the desert solar development, offering billions of dollars in federal loan guarantees, cash grants and tax breaks. On Monday, U.S. Energy Secretary Steven Chu announced $2.1 billion in federal loan guarantees for one project, a 1000-megawatt proposal near Blythe.

Another solar plant in development, Ivanpah in eastern San Bernardino County, received $1.37 billion in federal loan guarantees in February.

Janine Blaeloch, executive director of the nonprofit Western Lands Project, questioned the huge taxpayer commitment to the solar projects.

Blaeloch is a member of Solar Done Right, a coalition of public land activists, solar power and electrical engineering experts, biologists and renewable energy advocates critical of placing large solar projects on relatively unspoiled public land. She co-authored a report released earlier this month on governmental push for solar in the open desert, entitled “Wrong from the Start.”

She noted that corporate investors in companies developing solar projects in the California desert include Chevron, BP, Morgan Stanley and Goldman Sachs.

“It's big money and big oil,” she said. “It's the same people who have driven us into the hole we're in now trying to get us into another one.”

Perhaps ironically to some, the modern push for large-scale desert solar, it can be argued, started under former President George W. Bush and California Republican Gov. Arnold Schwarzenegger.

“The gold rush really started after George W. Bush signed the Energy Policy Act of 2005,” which provided tax incentives and loan guarantees for California desert solar development, Hersey said. “That's what really started the speculators.”

Under Democratic Gov. Gray Davis, California in 2002 passed a renewable energy portfolio standard calling for 20 percent of California's electricity to come from renewable sources by 2017. Schwarzenegger in 2006 moved the 20 percent target up to 2010.

Interest in solar development on federal land in the Southern California desert jumped from 20 applications in 2006 to about 150 the following year, said Greg Miller, BLM renewable energy program manager for the California Desert District.

“We had what we called a land rush,” he said.

BLM had previously approved use of federal desert lands for things such as power line corridors — never anything of the size of solar energy projects, Miller said.

“We were kind of learning as we were going,” he said.

In 2008, Schwarzenegger signed Executive Order S-14-08, streamlining renewable energy permitting and collaborating with federal agencies to develop the Desert Renewable Energy Conservation Plan, to facilitate desert energy development while maintaining natural resources conservation.

The push for solar has continued and expanded under Democratic President Barack Obama, whose administration has made green energy a priority, Hersey said.

“They can't do it fast enough,” she said.

Schwarzenegger and U.S. Interior Secretary Ken Salazar in October 2009 signed a memorandum of understanding between the state and Department of Interior that, among other things, developed a fast-track permit approval process allowing as many large-scale solar projects that could to begin construction by Dec. 1, 2010, making them eligible for American Recovery and Reinvestment Act, or federal stimulus, funding.

The fast-tracking “demonstrates how separate government processes can be coordinated without cutting corners or skipping any environmental checks and balances in the projects,” Salazar said Oct. 25 as he announced approval of the Blythe solar project.

BLM Director Bob Abbey in October acknowledged what was at stake.

“With something as momentous as the introduction of large-scale solar development on the public lands, we have one chance to do things right,” he said. “That's why we did complete environmental analyses on these projects with expanded opportunities for public participation.”

But Blaeloch questions that assertion.

“They are not saying to the public, ‘We want to know how you feel about this;' They're saying, ‘We're going to do this and you can comment on it if you want,'” she said.

“These solar plants will introduce a huge amount of damage to our public land and habitat. The sites will be turned into permanent industrial zones. Even if the plants are dismantled after their life is expired, you cannot restore the desert to what it was.”

Solar Done Right's report contends government officials could take advantage of already disturbed lands such as brownfield sites and former agricultural fields. The U.S. Environmental Protection Agency identified hundreds of thousands of acres of such sites, with the potential to generate 920,000 megawatts of solar electricity, the report notes. Distributed generation on rooftops is another option, Blaeloch said.

“I think those are really good questions to ask,” said Amy Fesnock, BLM's chief wildlife biologist in California.

“BLM doesn't have the ability to say, ‘Go build this on private land.' We don't have authority on private land. We can only assess the projects that are presented to us, on lands over which we have authority.”

BLM stands to bring in more than $10.2 million a year in rental fees from the solar companies permitted or nearing approval to locate in the desert, along with more than $25 million in additional megawatt capacity fees.

Hashing out the details

Though projects are approved with thick, multi-volume environmental impact statements, many details aren't yet resolved and are being worked out on the fly as work commences, including final plans on what will ultimately happen with endangered desert tortoise found on solar project sites.

Preliminary plans include moving the tortoise to other habitats, known as translocation — a controversial practice that top tortoise biologists say leads to high mortality rates.

A panel of independent scientists in October prepared a report for officials working on the Desert Renewable Energy Conservation Plan, that concluded: “In general, moving organisms from one area to another ... is not a successful conservation action and may do more harm than good to conserved populations by spreading diseases, stressing resident animals, increasing mortality, and decreasing reproduction and genetic diversity.

“Transplantation or translocations should be considered a last recourse for unavoidable impacts, (and) should never be considered full mitigation for the impact.”

In approving Ivanpah, California Energy Commissioners stated, “We assume that a substantial number of translocated tortoise may perish.”

But commissioners concluded the proposed mitigation efforts will make the impacts acceptable.

“Whether to approve this project or not is a policy decision to be made by the Energy Commission, after considering all the relevant factors, including scientific opinion,” they stated. “Input from the Advisory Panel is informative but we are not bound by any policy recommendations it makes.”

In addition to tortoise, the commission listed numerous other impacts from Ivanpah: loss of multiple-use lands, loss of habitat for the threatened Mojave milkweed and desert pincushion, increased traffic on Interstate 15 and degradation of scenic vistas. However, the commission found, the “project benefits outweigh the significant impacts identified.”

“The project helps address a global climate change problem of paramount importance and responds to state laws requiring a shift to renewable electricity sources,” the energy commission's Ivanpah decision states.

“Overriding concern” citations were used by the energy commission in the approval of other desert solar projects as well, said Jim Andre, a desert botanist with UC-Riverside's Granite Mountains Desert Research Center in eastern San Bernardino County.

“A decision is being made to waive significant impacts and to go forward with these projects as quickly as possible, without even acknowledging the science,” he said.

It's a similar story with cultural resources.

A June Energy Commission staff report on the Genesis solar project looked at cumulative impacts on cultural sites from past, present and likely future solar development.

“This analysis estimates that more than 800 sites within the I-10 corridor, and 17,000 sites within the Southern California Desert Region, will potentially be destroyed,” the report stated. “Mitigation can reduce the impact of this destruction, but not to a less-than-significant level.”

An economic boon

But large-scale desert solar development proponents say use of the BLM-managed lands provides an opportunity to shape projects in ways that minimize negative impacts that other tracts of land might not.

First Solar, a company based in Tempe, Ariz., is nearing final approval of its Desert Sunlight project, a photo-voltaic solar plant planned north of Desert Center, a tiny community about 50 miles east of Indio off Interstate 10.

The project at its inception secured 19,000 acres of BLM land, studied it with biologists and archaeologists, then scaled and modified the project footprint to minimize impacts to biological and cultural resources, First Solar project director Kim Oster said.

Removed were a bighorn sheep movement corridor, a potential desert tortoise corridor, an area of threatened foxtail cactus and “significant prehistoric resources,” she said.

“To combat climate change, changing our energy use has to be part of the solution. It will provide a significant solution to global warming for the future, while providing green jobs now.”

First Solar on Monday informed Desert Center community leaders of plans to provide a $350,000 community development fund for locally identified priorities such as local school and library improvements.

“Everybody around here thinks it's a great project,” said Ken Statler, owner of McGoo's Country Store in Desert Center.

“They're willing to help out the county and the area. There are no jobs available out here.”

The solar construction and ongoing operational jobs will “undoubtedly” help his store, Statler said.

“Where else are they going to get anything?” he said. “We had two other mini-marts out here and they closed down. You can't get gasoline; it's closed down.

“We need some life out here in the desert. That will definitely help us.”

Desert Center resident John Beach earlier this month landed a job in procurement with NextEra's Genesis project.

The currently proposed projects “bring an economic boost to an area that has very high unemployment and not very much in the way of business,” he said.

But community members generally are more apprehensive about what may be coming later, Beach said.

Federal agencies are currently working on an overarching framework for solar development on public lands in six western states, including California, called a solar programmatic environmental impact statement.

The plan calls for creation of 24 federally designated solar energy zones, areas deemed most likely to work for large-scale solar development while minimizing environmental and cultural impacts. The largest of the zones, at 202,000 acres, is in eastern Riverside County's open deserts.

“That's not reasonable,” Beach said.

“We're going to end up having a disproportionate share of all of the projects and having no more open desert. People are saying that doesn't sound right.”

But the federal report recommends opening up even more land to solar development than the 667,384 acres currently under consideration across western states. Another 21.5 million acres of federal land could be considered for renewable energy development, including 1.7 million more acres in California, with 205,000 acres of the total in the deserts surrounding the Coachella Valley.

Though more than a dozen major solar projects have been approved or are nearing approval, the work on considering the cumulative impacts of them all is in many ways only beginning.

The Desert Renewable Energy Conservation Plan is not scheduled for completion until next year.

“The goal of the DRECP is to approach renewable energy in a more organized fashion. The question really is, will that be in place in time to be of benefit to the planning?” said Gail Barton, principle planner for Riverside County and the county's representative on the committee developing the plan.

Solar projects are currently being considered “consistently with the law,” Barton said.

“Is that the best kind of planning? Probably not. With more comprehensive planning, you tend to look more thoughtfully at things.”

In December, after approving seven large desert solar projects, the California Energy Commission solicited applicants to conduct a study examining the “cumulative biological impacts framework for solar energy projects in the California desert.”

A Sierra Club lawsuit against the Calico solar project in San Bernardino county was dismissed by the California Supreme Court April 13. Legal challenges remain on other solar projects, filed by both environmentalists and tribal members who claim they were not properly consulted, and that the projects fail to protect species and cultural sites as required under federal law.

To many in the rest of the country, local concerns about the desert solar projects' impacts aren't the priority.

“Societally, this is the kind of change that helps the whole country, the whole world,” said Kenneth Zweibel, director of the George Washington University Solar Institute in Washington, D.C.

“There's much bigger value in helping the whole society, the whole world, than in the local issues. Something you are trying to protect is being changed, but it's helping so much in terms of climate change, energy self sufficiency and clean energy, it's a sacrifice that's appropriate to take.”

Sunday, April 17, 2011

Clean Energy Spared The Budget Axe - For Now. An Update from Politico

Alternative energy runs into headwind

By DARREN SAMUELSOHN, POLITICO.COM

Clean energy technology champions are scrambling to secure the tax breaks. Photo by AP Photo

For the renewable energy sector, it’s a wonder either wind or solar power is still standing.

Austere budgets and small government have become Capitol Hill credos, and clean energy technology champions are scrambling to secure the tax breaks and loan guarantees they’ve depended on over the past decade to drive investments.

Cheap natural gas is beating renewables as the lowest-cost option for meeting the nation’s thirst for new electricity.

Scathing media reports have also raised questions about whether the Obama administration favored its green-tinted campaign contributors with federal stimulus dollars and wound up sending upward of three-quarters of the subsidies to companies that are now based overseas.

And when the industry does show signs of life, wildlife advocates and environmentalists have been making it difficult by blocking transmission lines to get the clean energy to urban centers.

Moderating an Import-Export Bank conference panel earlier last month alongside several top energy industry executives, Carol Browner, President Barack Obama’s former top energy adviser, bemoaned the lack of a long-term market signal to help renewables. Without private entrepreneurs, she said, the already small U.S. market could be swamped by foreign competitors.

“This is an industry evolving rapidly, whether it be on the supply or demand side,” Browner said. “From my perspective, on the public policy side, we need to do more to ensure there is demand for the technology. We are in danger of not being at the forefront of the industry. It’s because of people like this we’re at least able to hold on.”

John Denniston, a partner at venture capital firm Kleiner Perkins, sounded off on the disparity, too, ticking through the top 20 renewable energy companies in the world and noting that just four are American.

Exactly what the federal government can do is a question.

Obama promised to put solar panels on the White House roof last year and has continued to talk up renewable energy. During a visit earlier this month to a wind turbine manufacturer in suburban Philadelphia, Obama pledged to keep up the fight to make the renewable industry’s tax credits permanent — rather than leave them exposed to the often last-minute dash for renewal.

“I want to kick-start this industry,” the president said. “I want to make sure it’s got good customers, and I want to make sure the financing is there to meet that demand.”

But several market experts doubt Obama can live up to his promises. While the solar tax credits are secure through 2016, wind will see some of its most cherished benefits expire at the end of 2012, just after the presidential campaign.

“We’ve seen this movie a number of times,” said Rob Gramlich, senior vice president for public policy at the American Wind Energy Association.

Some of the long-term options are also no longer looked at so kindly on Capitol Hill, either.

Former Senate Energy and Natural Resources Committee Chairman Pete Domenici had once floated the idea of establishing a “green bank” that would put financial experts in place in the evaluation of clean energy projects. A similar idea is now a centerpiece of the Democrats’ energy plan, which makes it more likely to fall to partisan sniping.

“The Republicans are calling it a Fannie and Freddie for clean energy, but they don’t mean it in a nice way,” said Kevin Book, managing director of the Washington research firm ClearView Energy Partners.

Renewable advocates insist they long ago gave up on the idea of pricing carbon emissions as a way to get a toehold against their coal, natural gas and nuclear rivals. Now, they’ve put their eggs in another basket: the “clean” energy standard that Obama mentioned in January’s State of the Union speech.

But even here, their preferred policy approach appears to be stuck in congressional low gear.

“I think the door is cracked open and therefore worth pursuing,” Gramlich said.

House Energy and Commerce Committee Chairman Fred Upton may be the biggest barrier to a “clean” energy standard. He opposes federal mandates and has shown no interest in responding to the issue, even if the Senate somehow were to come up with 60 votes on legislation.

In an interview, the Michigan Republican insisted that he wants to expand the nation’s renewable portfolio. But he quickly ticked through a number of the industry’s downsides.

“Solar would be dead without the extension of the tax credits about a year and a half ago,” he said. “So they continue to push out.”

Upton also took issue with local activists and environmentalists who have made it more difficult to get wind energy into the transmission system by challenging various transmission projects.

“That’s the dilemma,” he said. “You’ve got different groups challenging the building to improve the grid. It’s a problem.”

Despite the hurdles, industry officials see themselves in a strong light.

Wind produces about 2 percent of the nation’s electricity. That’s up from less than 1 percent in 2005, with turbines now churning out more than 40,000 megawatts of power — enough to supply electricity to more than 10 million homes.

Solar power is in its own camp. It still hovers below 1 percent of the nation’s energy pie. Its small size makes its growth look even bigger. Investments jumped from $3.6 billion to $6 billion last year. As of 2010, there’s more than 1,000 megawatts of installed capacity, up from 320 megawatts in 2008.

“We’re the fastest-growing industry in the United States, period,” said Rhone Resch, president of the Solar Energy Industry Association.

Indeed, both wind and solar can point to some useful figures as they try to sway political doubters. In 2010, 14 wind manufacturing plants opened, giving the industry 20,000 jobs stretched across 42 states. Fifty-eight new solar panel factories have opened in the past 18 months. Solar officials tout a similar number of jobs spread across 47 states.

Industry observers say wind and solar, while in different camps in terms of recent growth, can at least take heart in the policies they have been able to latch onto.

“It could have been worse,” Book said. “It could have been the case there was no stimulus to spend. It could have been the case that there was no grant program. It could have been the case there was no production tax credit.”

Tuesday, February 8, 2011

Energy priorities for the 112th Congress (Sen. Jeff Bingaman) - The Hill's Congress Blog

Sen. Jeff Bingaman (D-N.M.) gave these remarks Monday at the New Democratic Network and National Energy Policy Institute.

At the beginning of this new Congress, it is already becoming clear that energy policy will have a major place on this Congress’ agenda.

Part of that is because the President made clear last week in his State of the Union speech he will give energy a major priority in his administration.

In part, it is because our energy security is dependent on overseas supplies and global stability. The events that we have seen unfold in North Africa and the Middle East are stark reminders that the world is an unpredictable place. Whenever geopolitical events potentially affect our access to affordable energy supplies, it is a spur to consider energy policies that might reduce those geopolitical risks.

But perhaps more important than any of those reasons is the competitive pressure we are experiencing from other major world economic powers, as they take a very leading role in clean energy markets.

According to Bloomberg New Energy Finance, new investment in clean energy globally reached nearly a quarter of a trillion dollars in 2010. That was a 30 percent jump from where it was in 2009, and a 100 percent increase from the level in 2006.

China alone invested $51.1 billion in clean energy in 2010, making it the world’s largest investor in this sector. China now manufactures over half of the photovoltaic modules used globally. In 2010, China installed about 17 gigawatts of new wind capacity – roughly half of the total capacity installed globally – with virtually all the equipment being supplied by its domestic manufacturers.

But the concern about the competition for clean energy jobs is not just about China. Europe also made major strides last year towards competing in these markets. Countries like Germany, the Czech Republic, Italy, and the United Kingdom, have emphasized small-scale distributed electricity generation projects. In Germany, 8.5 gigawatts of new photovoltaic capacity were added in 2010. So there is a lot going on around the world in that area.

We also see that other countries consume energy more efficiently than we do. According to the International Energy Agency (or IEA), Japan, the United Kingdom, and Canada are all ahead of the United States in implementing policies to make sure they get the most out of every BTU that they consume. Japan has its “Top Runner” program, which encourages competition among appliance and equipment manufacturers to continuously improve the efficiency of those appliances and that equipment.

So the question is, how do we respond to this competitive world for the clean energy jobs? I believe that to remain at or near the forefront of this strongly developing market, we need to do at least four things:

First, we need to ensure that we remain at the forefront of energy research and development, since innovation is the source of our greatest competitive strength. The President made that point in his State of the Union Speech and in other forums, as well.

Second, we must ensure that we have a strong domestic market for clean energy technologies. Without clean energy market-pull in the United States, there will not be the incentive to manufacture and deploy these technologies here.

Third, we have to ensure that we have the necessary financial infrastructure and the incentives to provide the capital needed to build advanced energy technology projects.

And finally, we need to have explicit policies to promote the development of U.S. manufacturing capabilities for these clean energy technologies

I think these four items or elements should be at the heart of whatever comprehensive energy legislation that we undertake in this Congress. Let me say a few more words about each of them.

The first item to consider is support for advanced energy technology R&D. America has traditionally led the world in many of the characteristics that are essential to having an innovation economy. We have the predominant share of the world’s best research universities. We are the world’s largest source of financial capital. We have a disproportionate share of the world’s leading innovators in high technology. But these advantages are shrinking rapidly. In 2007, United States energy research expenditures were at about 0.3 percent of GDP. Japan was at about 0.8 percent of GDP and even China was about 0.4 percent. Since then, our overseas competitors have significantly increased their research investments in energy, while our own investments in this area have grown only modestly. It is clear that if we are to put together any kind of bill that deserves to be labeled as comprehensive energy legislation, we need to address the huge gap between where our investment in energy technology research is and where in fact it ought to be.

In his State of the Union address, President Obama correctly identified this as a major priority for the appropriations process this year. Secretary Chu will appear before the Committee on February 16 to testify about the details of the President’s plan for funding, which will be released on Feb. 14.

The second item is ensuring robust domestic demand for clean energy technologies. It is not enough just the support the research. Getting clean technologies developed, manufactured and deployed here in the United States will require a robust and certain demand for clean energy in the marketplace. This reality was underscored to me during a trip recently to Silicon Valley. I spoke to various people there involved in financing and developing clean energy projects. The message I heard consistently was that uncertain U.S. demand for clean energy is preventing many promising clean technologies from being developed in this country. Companies will not establish a manufacturing base where they do not see a strong market. Private capital sources are, in fact, exerting intense pressure on American clean energy innovators to establish their manufacturing base overseas, where government policies are creating this strong clean energy demand.

So, we have to take seriously the marketplace reality that the high-wage, clean-energy manufacturing of the future will be located both close to demand and in countries with the most favorable clean energy policies. My desire is to see the United States lead the world in renewable energy manufacturing so all of the solar panels and wind turbines that we install around the country are not stamped “Made in China” or “Made in Germany.” This is the key reason why I have long supported a Renewable Electricity Standard. We need to provide long-term market predictability for renewable electricity. Our on-again, off-again production tax credits are no match for the comprehensive approaches being put in place by our economic competitors.

The third item is support for deployment. We have to have policies to encourage deployment of these technologies. While end-use demand is certainly one of the first things an entrepreneur or potential investor looks at when deciding where to locate operations, the analysis does not end there. An equally important question is – Is there a path to full commercialization of this technology? How do we build the first-of-a-kind project (or the first-few-of-a-kind projects) utilizing a new clean energy technology to demonstrate its actual cost and performance? This is what the private sector wants to see before it will invest in a technology.

This is a particular problem for clean energy technology, because the capital costs in this area are higher than previous high-tech success stories in the United States such as IT or biotechnology. No investor in today’s marketplace can match these capital requirements by themselves. Our competitors in Asia and Europe have set up institutions to address the problem. They have already successfully lured companies to commercialize and manufacture their U.S.–developed clean energy technologies in those markets. We need to set up similar institutions if we hope to support clean energy jobs here in the United States.

The fourth element I mentioned was support for manufacturing. If we want clean energy jobs, we need to have policies to encourage manufacturing to occur here. In addition to providing a predictable market for clean energy and a robust financing capability for first-of-a-kind projects, we need to have incentives for manufacturing the critical components for clean energy technologies. Other countries, most notably China, have complemented their clean energy market standards with robust tax incentives and other fiscal subsidies specifically targeted at manufacturing clean energy components. And as a result, the U.S. has gone from being a world leader in producing clean energy technologies and enjoying a “green trade” surplus of more than $14 billion in 1997, to a “green trade” deficit of nearly $9 billion in 2008. We cannot afford to sit idly by as our economic competitors move clean energy manufacturing steadily overseas, and deprive Americans of solid job opportunities.

So these are four key strategic elements that need to be included in any energy legislation in this Congress, if an energy bill is to help us compete in global energy markets in the future. None of these individual ideas are new, but their interconnection is now more apparent. A few years ago, we thought that we could do just one or a few of these things and be successful. It is now clear that you must do all four of them and do so on a level that is competitive with what other countries are doing.

Let me now describe some of the specific policy initiatives that I think will be very timely for us to pursue in the Senate this year. Most of these initiatives will be items I hope to champion in the Committee on Energy and Natural Resources. This is not intended to be an all-inclusive list. The committee has 22 Members, many of whom have just been appointed. I anticipate a lot of meetings and bipartisan dialogue over the next few weeks as we work out our legislative roadmap for this Congress. But the following topics are issues that I think are particularly crucial for us to address. They are also issues where we did have strong bipartisan consensus in the 111th Congress. This gives us a good place to start our deliberations this year.

The cheapest energy is the energy we do not have to use by operating more efficiently. So, clearly where I’d start with is energy efficiency. In the last Congress, we had a very productive dialogue in the Energy Committee and among businesses, manufacturers, and efficiency advocates interested in appliance and equipment energy efficiency. The result was a package of legislative provisions that codified consensus agreements to update certain existing appliance standards, to adopt new appliance standards, and to improve the overall functioning of the Department of Energy’s efficiency standards program. Many of these efficiency provisions were part of the comprehensive energy bill we reported out of Committee in 2009. Others were subsequently approved by the Committee or part of bipartisan bills.

These sorts of standards are essential if U.S. appliance manufacturers are to remain competitive in world markets, which will increasingly demand highly efficient appliances and equipment. By ensuring a strong domestic market for energy efficient products, we keep innovation and jobs here in America, while realizing significant energy and water savings, and major cost-savings to the American consumer.

Obviously we had great difficulty in getting any sort of legislation though in the lame duck session of the last Congress; we were not able to enact these consensus provisions. We had overwhelming, broad bipartisan support, but not unanimous support in the Senate. This is an important piece of our early agenda in this Congress, and I hope we can introduce it soon. My staff has been working with the consensus group of stakeholders on some further technical changes to last year’s package. I plan to introduce a revised package within the next week or two.

There is also much that can and should be done to promote efficient use of energy in other parts of the economy.

In residential and commercial buildings a broad coalition supported Home Star, a program for residential building efficiency. I hope we can move forward on this. Similar interest was apparent with commercial buildings in a program called Building Star. I hope to move one or both forward. In transportation, two proposals from last Congress deserve a closer look.

First, we should provide a greater point-of-sale incentive to vehicle purchasers, with dealership rebates that would be larger for the more fuel-efficient cars. Senators Lugar, Snowe and others cosponsored this legislation with me in the last Congress. A second set of proposals dealt with diversifying the sources of energy that we use in transportation. This bill was Senators Dorgan and Alexander’s proposal and passed out of the Energy Committee on a very large 19-4 vote.

Energy efficiency in manufacturing and industrial operations is also important. The legislation reported by the committee last year contained a comprehensive program on manufacturing energy efficiency that had good bipartisan support. Again, I hope we can move forward with this legislation, too.

Another priority is the one highlighted by the President in his state of the Union speech – moving to a cleaner energy mix in the way we generate electricity.

For a number of years I have advanced a proposal for a Renewable Electricity Standard, to ensure a long-term and predictable demand for renewable clean energy resources. The President proposed to expand upon that concept by including a broader suite of technologies such as nuclear energy, coal with carbon capture and storage, and natural gas generation. The President’s stated goal, as he described it, is to achieve 80 percent of our electricity from such clean energy sources by 2035. The White House has asked us to work with them to see how the provisions for this Clean Energy Standard would be developed. Obviously, there are a lot details to work out. I am pleased that the Administration has reached out to the Committee to consult on this subject.

Perhaps no topic garnered more scrutiny during last Congress’s markup that the Renewable Electricity Standard. I plan to work with colleagues on both sides of the aisle in the Committee to determine how we can craft a workable legislative proposal to achieve what the President has set out as his goal. As we do so, a number of key design questions will need to be answered, such as, what counts as a clean energy technology? How does the proposal account for existing clean energy sources? Does the credit trading system that we have developed for renewables in our proposal for renewable resources fit with these other resources?

With respect to financing assistance for energy projects, I think there are at least three top priorities for early attention in this Congress: reforming the current loan guarantee program for clean energy projects, providing financing support for advanced energy manufacturing in this country, and providing reasonable stability and predictability in the tax provisions that apply to clean energy projects and technologies.

The first of these is to replace the current loan guarantee program for clean energy technologies with a Clean Energy Deployment Administration, or CEDA. CEDA would be a new independent entity within DOE, with autonomy like the Federal Energy Regulatory Commission has. It would provide various types of credit to support deployment of clean energy technologies including loans, loan guarantees, and other credit enhancements.

This proposal was strongly supported on a bipartisan basis in the Committee as part of the larger energy bill we reported. It also had a broad range of external support from clean energy developers, innovators, and venture capital firms. Fixing the problems of the current DOE loan guarantee program, and ensuring that we have an effective financing authority for a broad range of clean energy technologies, including renewables, nuclear, energy efficiency, and carbon capture and storage, needs to be one of our highest priorities. I am committed to moving ahead with that legislation in this Congress.

The second priority in the area of financing assistance relates to encouraging the location of manufacturing facilities here and replenishing the fund to award tax credits under section 48C. This section provides up to a 30 percent tax credit for the costs of creating, expanding or reequipping facilities to manufacture clean energy technologies.

The initial funding was vastly oversubscribed – the government received $10 billion in applications for $2.3 billion in tax credits. This is a powerful demonstration of the potential for clean energy manufacturing that exists in this country. In the last Congress, Senators Hatch, Stabenow, and Lugar joined me in filing the American Clean Technology Manufacturing Leadership Act. This bill would have added another $2.5 billion in tax credit allocation authority. President Obama has since called for an additional $5 billion. I hope we can help reintroduce bipartisan legislation to ensure this credit’s continuation at the President’s proposed level. While this is a matter that will be handled in the Finance Committee, it is an important near-term bipartisan opportunity in this Congress.

The third essential element is to bring stability and predictability to this part of the tax code in order to attract private capital to clean energy projects. If you look at this part of the tax code, many of the energy-related tax incentives will expire at the end of 2011, including the section 1603 program, the credit for energy-efficient residential retrofits, the credit for construction of new energy efficient homes, the credit for energy efficient appliances, the incentives for alcohol fuels (mostly ethanol), biodiesel and renewable diesel. Other energy-related tax incentives are set to expire at the end of 2012, 2013, and 2016.

One other major challenge and priority for the Committee in this Congress will be to address the proper and effective regulation of energy development to order to protect the public health and safety and the environment. I met this morning with Michael Bromwich, the Director of the Bureau of Ocean Energy Management, Regulation and Enforcement (BOEMRE). Clearly he is working very hard to get his arms around this critically important issue.

One of the important lessons learned from the National Commission on the Deepwater Horizon Oil Spill is that, in the long run, no one –least of all the regulated industry – benefits from inadequate regulation and underfunded regulators. In the aftermath of the Deepwater Horizon disaster, the Committee on Energy and Natural Resources last June came together and unanimously voted out a bipartisan bill to address the key problems uncovered by our hearings on the disaster. Unfortunately, Congress did not enact our bipartisan bill.

Our first hearing of this Congress, last week, heard from the co-chairmen of the President’s Commission on their recommendations. I hope to introduce on a bipartisan basis a follow-on bill to last year’s legislation in the near future. I hope that we can repeat our bipartisan success of the last Congress in developing a bill that recognizes our need to develop the rich resources of the Outer Continental Shelf, but also minimize the potential impacts of developing those resources on the marine and coastal environment and on human health and safety. This is important work that needs to be completed.

Finally, an item that I hope we can address early in this Congress in the Energy Committee deals with perhaps the most pressing energy security problem we have. That is the vulnerability of our electrical grid to cyber attack. A major disruption of the electric transmission grid, or the equipment it contains, as part of a cyber attack could have disastrous consequences. We need to ensure that adequate preventative measures are in place across the grid. The problem is that we don’t currently have mechanisms to ensure that these needed steps are being taken. The whole grid is as vulnerable as its weakest link. In the last Congress, our Committee twice passed legislation to address this need. The House of Representatives also sent a bill to the Senate on this subject, but again, due to the inability to process legislation in any mode other than unanimous consent in the Senate, we were not able to pass the legislation into law, nor take the needed steps to ensure the security of our grid. I hope to work with the Members of the Committee on both sides to deal with this issue early in this Congress.

So in conclusion, I have laid out a pretty aggressive opening agenda for the Committee. This week, we have two hearings – one to advance a bipartisan bill to ensure our nation’s future supply of medical isotopes and the other to raise the curtain on energy activities and issues generally in this Congress.

Next week, Senate Democrats are away from Washington for several days for an issues conference, so our Committee will not have formal meetings.

Following the release of the President’s budget on Feb. 14, we will hear from Secretary Chu on Feb. 16 and then from Secretary Salazar and the Chief of the Forest Service on their budget requests in the first week after the President’s Day recess. When we finish with our duties to scrutinize the Budget request, we will return to legislative hearings on energy. By that time, I hope that we have sufficient bipartisan engagement with both the returning and the new Members of the Committee that we can start making good progress on developing one or more energy bills for the full Senate to consider in the first several months of this year.

Thanks again to Simon Rosenberg and the NDN for giving me this opportunity to talk about our agenda for the early part of this Congress.

Sen. Jeff Bingaman (D-N.M.) is the chairman of the Senate Energy and Natural Resources Committee.

Monday, January 24, 2011

Chadborne & Parke LLP's Project Finance NewsWire January 2011

Click here for Chadborne & Parke's latest Project Finance Newswire, which we consider to be required reading for clean energy project finance participants.

IN THIS ISSUE

1 More Subsidies for US EnergybProjects

8 DOE Loan Guarantee Update

12 California Cap-and-Trade Program Takes Shape

15 California Settlement Settles Old Scores and Charts New Paths for Generators

18 Master Financing Facilities for Solar Projects

29 Turkey Moves to Boost Renewable Energy

31 Cellulosic Biofuels: The Future Is When?

38 PPPs in the Middle East

42 Environmental Update

IN THIS ISSUE

1 More Subsidies for US EnergybProjects

8 DOE Loan Guarantee Update

12 California Cap-and-Trade Program Takes Shape

15 California Settlement Settles Old Scores and Charts New Paths for Generators

18 Master Financing Facilities for Solar Projects

29 Turkey Moves to Boost Renewable Energy

31 Cellulosic Biofuels: The Future Is When?

38 PPPs in the Middle East

42 Environmental Update

Tuesday, October 19, 2010

Solar Thermal vs. PV - A Brief History and Update

Are Solar Thermal Power Plants Doomed?

4 comments | by: Greentech Media / Seeking Alpha October 18, 2010 | about: ABGOY.PK / AMAT / NRG / SGFRF.PK / SPWRA / TAN / TSRA

by Michael Kanellos, Brett Prior

Concentrating Solar Power [CSP] is one of our favorite renewable energy technologies, but it might be in serious trouble. And this time the culprit is not cheap natural gas, the Koch Brothers, nor the desert tortoise advocates.

This time, the adversary is the other half of the solar family.

Just to clarify, CSP includes all concentrating solar thermal (CST) technologies, such as trough, tower, and dish-engine - as well as concentrating PV (CPV) technologies including companies such as Amonix, SolFocus, and Concentrix.

The CSP industry began to flourish in the late 1980s and early 90s in California, with the construction of 354 megawatts of parabolic trough plants in the Mojave Desert.

Then, the state allowed a real estate tax exemption lapse, a change in the law that companies like Solel and Luz warned would kill them. Right after Luz ran out of money, then Governor Pete Wilson signed an extension.

A second wave began around 2004 with the revival of green technology in the state. Luz founder Arnold Goldman rounded up the old team, recruited some new execs and founded BrightSource Energy. Peter Le Lievre and a group of Australians came up with Ausra and built a plant in Las Vegas.

Advocates said that solar thermal plants, if 500 megawatts or larger, could rival natural gas in cost per kilowatt hour. Another lapse in the property tax exemption loomed, but was avoided.

But then the 2008 financial crisis hit. The sudden decline of funding hit the industry particularly hard, considering that a demo plant costs around $25mm and a commercial plant requires somewhere north of $250mm. Ausra and eSolar had to retool their strategies, while BrightSource had to sell part of its first project at Ivanpah to Bechtel.

If that weren’t enough, environmentalists and U.S. Senator Dianne Feinstein pushed to declare a million acres of the Mojave a protected zone. Concerns about desert tortoises forced BrightSource to scale Ivanpah down to 370 megawatts. It was as if 19th Century coal miners blamed their lot on the gruel purity standards being imposed on mining camp cafeterias.

But the projects have, in recent weeks, begun to get the necessary approvals from the California Energy Commission and the Bureau of Land Management, just in time to qualify for the Treasury Grant program.

So the near term outlook for CSP looks pretty bright, as BrightSource's Ivanpah, Abengoa's (ABGOY.PK) Solana, and Tessera's (TSRA) Imperial all look likely to break ground this year.

So, what could derail CSP's longer term prospects?

PV, that’s what.

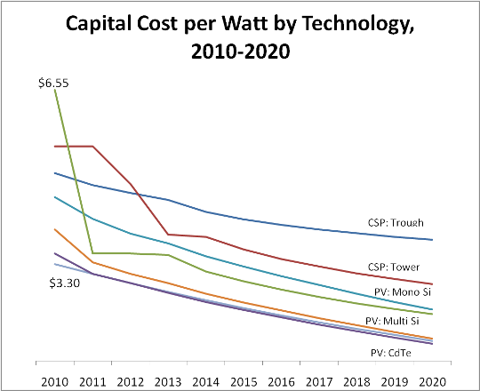

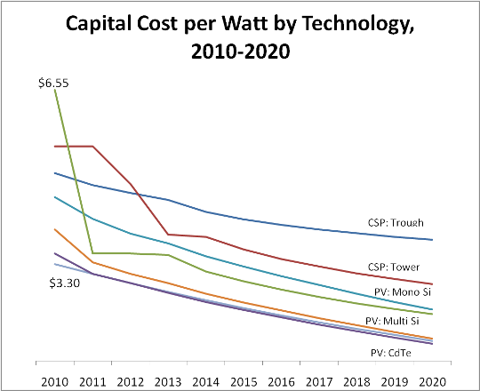

The relentless price declines of PV panels allows developers to build PV plants at a lower cost than their CST cousins. This issue is illustrated in the following Capital Cost per watt chart (an excerpt from the upcoming GTM Research "CSP Report"). In 2010, the price to build a CSP park run by Troughs, Power Towers or Dish-Engines will cost between $5.00 and $6.55 per watt (AC). On the other hand, utility-scale PV projects can limbo below $3.50 a watt (DC).

By 2020, the CSP solutions are expected to be in the $2.40-$3.80 per watt (AC) range, but by that time PV plants could be below $2 a watt (DC). Trough & Tower plants are behind PV, and not likely to catch up.

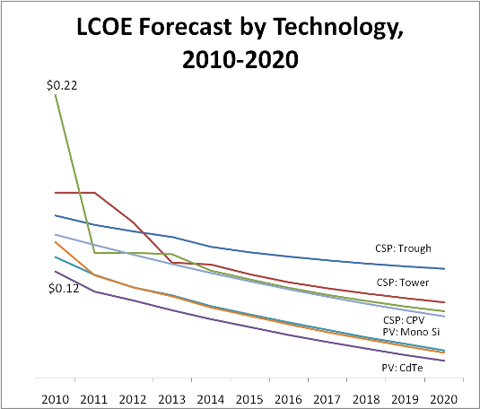

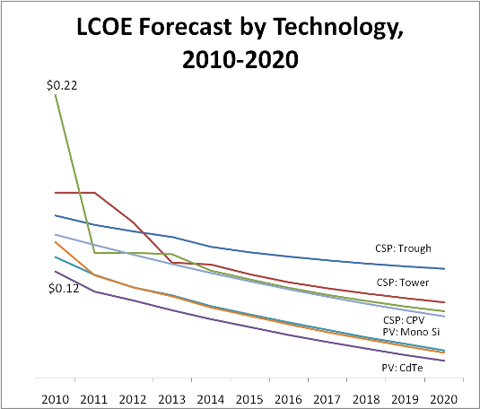

The better comparison is levelized cost of energy (LCOE) - as this corrects for the DC-to-AC conversion that PV needs to deal with, the differences in O&M, and the differing amounts of kWh generated per watt of equipment installed (as yields vary by technology).

This second chart depicts the LCOE on an apples-to-apples basis (same location, same plant size, same financing terms). Again, PV is cheaper today, and expected to widen its edge over the next decade. By 2020, the CSP technologies are expected to be in the $0.10-$0.12/kWh range, whereas PV is forecast between $0.07-$0.08/kWh.

A bleak outlook?

As a sign of the times, NRG Energy (NRG) decided that instead of building CSP plants using eSolar Towers, it would use the sites for PV plants. The company did this both in California (Alpine SunTower), and in New Mexico.

This sort of reversal wasn’t expected in 2006 or 2007, but since then the Chinese have ramped up their solar PV manufacturing, the cost of polysilicon has slid dramatically, and the overall cost of PV modules has declined significantly. Both Solon (SGFRF.PK) and SunPower (SPWRA) now make solar power plants “in a box” that can generate 1 megawatt. They come straight from the factory on big rigs.

If you accept the following 2 premises, the future for CSP looks pretty bleak.

1) PV is now cheaper than CSP on a levelized cost basis, and will reduce its costs faster than CSP going forward

2) When awarding solar power purchase agreements ((PPAs)), utilities will choose the lowest price option

What could prevent this scenario from coming to pass?

One possibilty is that utilities are willing to pay a premium for CSP plants for one of two reasons:

i) CST plants produce more consistent power output (less spikiness). These plants can produce power fairly consistently throughout the day because of the inertia of the turbine and the ability to burn natural gas when clouds roll in. When clouds blanket a PV plant - the output can drop off a cliff. The last time the solar thermal plants in the Mojave experienced an eyebrow-raising drop in power it was because Mt. Pinatubo blew.

ii) CST power plants fit naturally with storage systems and can even continue to produce power at night. For now, if utilities want solar with storage, the only economic option is CST (trough or tower). Perhaps at some point in the future new technologies like sodium batteries and dry cell batteries from Xtreme Power may help PV developers even the storage gap.

Are utilities willing to take quality or storage into account? Apparently not at the moment.

“Utilities aren’t willing to pay for consistency and storage,” said Brad Friesen, Vice President of the Renewables business line at Fluor, one of the largest EPC (engineering, procurement, & construction) firms in the world. Most of the utilities are concerned about meeting their renewable portfolio requirements, he said. Five years from now utilities might question their thinking, he added, but right now, these considerations are not given much weight.

And price is not the only area where CST plants are disadvantaged.

Lack of Modularity

Trough and tower plants require large turbines to operate - and the economics for steam turbines only work with 50 MW+ plants. So modularity is not an option for CST plants.

Developers have figured out that it is much easier (and faster) to site, permit and get transmission arranged for a sub-20 MW plant than it is for a larger project. That effectively rules out trough and tower - but allows for traditional flat-plate PV, CPV, and potentially Dish-Engine options.

Restricted geography

The economics of CST require that they be located in a more constrained geographic band.

Conclusion?